Image by Kseniia Ilinykh via Unsplash

As the world’s two largest producers of palm oil, Malaysia and Indonesia prove valuable case studies for tracking deforestation trends. Using high-resolution satellite imagery and advanced data analytics, Satelligence has monitored annual deforestation rates, identified the companies with the highest deforestation levels in 2024, and assessed the remaining forest cover within concessions. The findings offer a clear, data-driven comparison of deforestation trends in both countries, helping stakeholders navigate the challenges of sustainable palm oil production with accurate insights.

Our responsibility to our clients goes beyond service provision – we understand the complexities of global supply chains and work together with stakeholders to ensure their resilience. The Satelligence platform enables clients to directly access satellite data, as well as our proprietary/in-house analysis and key insights, to detect deforestation in real-time and with the highest accuracy.

Overview: What Did We Find?

In January this year, Satelligence shared its analysis and insights relating to Malaysia and Indonesia’s deforestation trends in an exclusive webinar with industry experts from GAR, LDC, Nestlé, Tony’s Chocolonely.

At this moment, Indonesia’s oil palm concessions amount to 24.3 million hectares and Malaysia’s to 5.5 million hectares. 2016 saw a peak in deforestation for both countries, but whilst Malaysia has maintained a lower deforestation rate in recent years, Indonesia has experienced an upward trend since 2021. As well as this, we also see that a higher proportion of companies in Indonesia remain non-deforestation-free compared to Malaysia. Satelligence data also highlights the varying levels of remaining forest within concessions, with Indonesia retaining a larger percentage of forested areas than Malaysia.

Thanks to a nuanced approach to satellite monitoring, and an ability to track forest dynamics over time, we are able to paint a highly accurate and detailed picture of a region’s deforestation trends, leading to more informed decision-making in supply chain management. Whilst open data sources report similar findings, it is our ability to provide clients with this data by way of refined, tangible insights in real-time that contributes significantly to the resilience of their supply chain. Flagging deforestation risk areas as they occur, at a consistency they can rely on, means clients can act fast to address and mitigate.

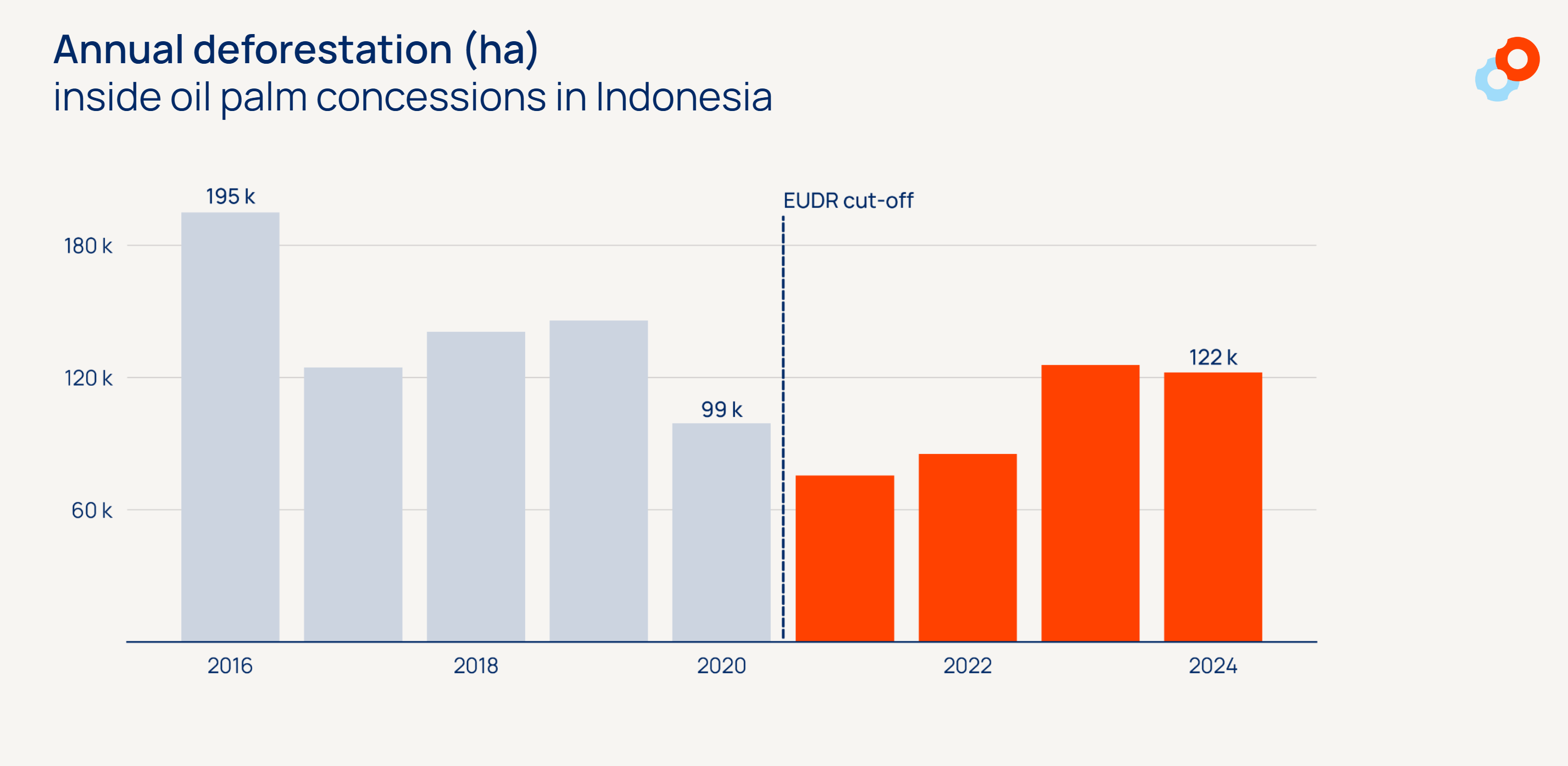

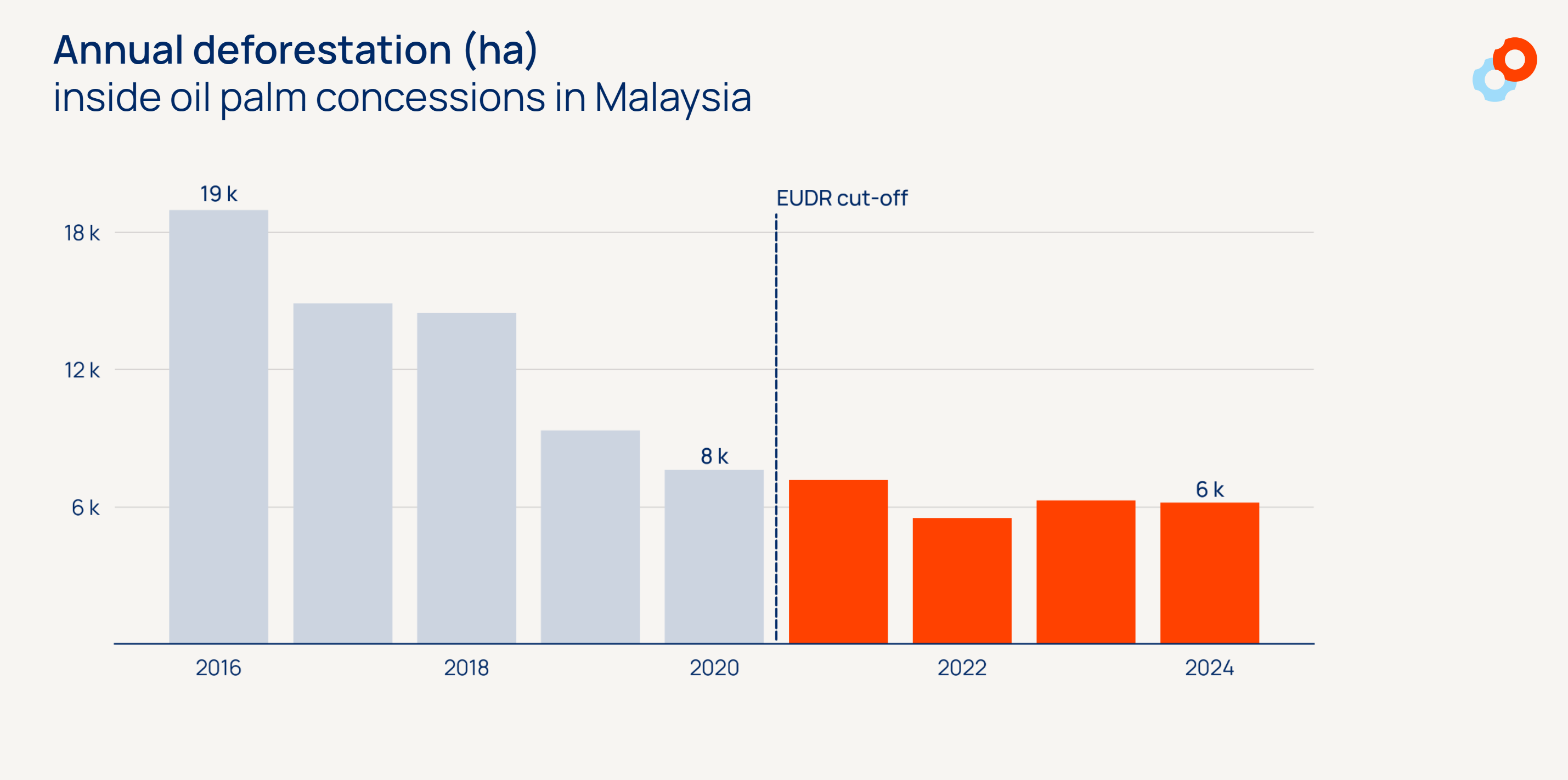

Data comparisons show that both countries experienced high levels of deforestation in 2016, but trends diverged in the years following.

Deforestation Trends (2016-2024): A Data-Driven Comparison

Our analysis reveals distinct deforestation patterns in oil palm concessions across Indonesia and Malaysia. As mentioned, both countries saw their highest deforestation levels in 2016 (following a continued rise in previous years), with a loss of 195,000 hectares in Indonesia and 19,000 hectares in Malaysia – this is likely to reflect a correlation between the dynamics of deforestation and the pricing of crude palm oil. Although deforestation rates declined in the years following, Indonesia has experienced a steady increase since 2021, with 122,000 hectares lost in 2024. Meanwhile, Malaysia’s deforestation rate has remained stable, with approximately 6,000 hectares lost in 2024, a level consistent with previous years.

Crucially, in the context of EUDR and its December 2020 cut-off, this equates to close to half a million hectares of deforestation within Indonesia’s oil palm concessions.

Companies with the Highest Deforestation Rates in 2024

Deforestation trends in concession areas evolve over time. Accurate historical data helps assess future risks and supports sustainable supply chain management.

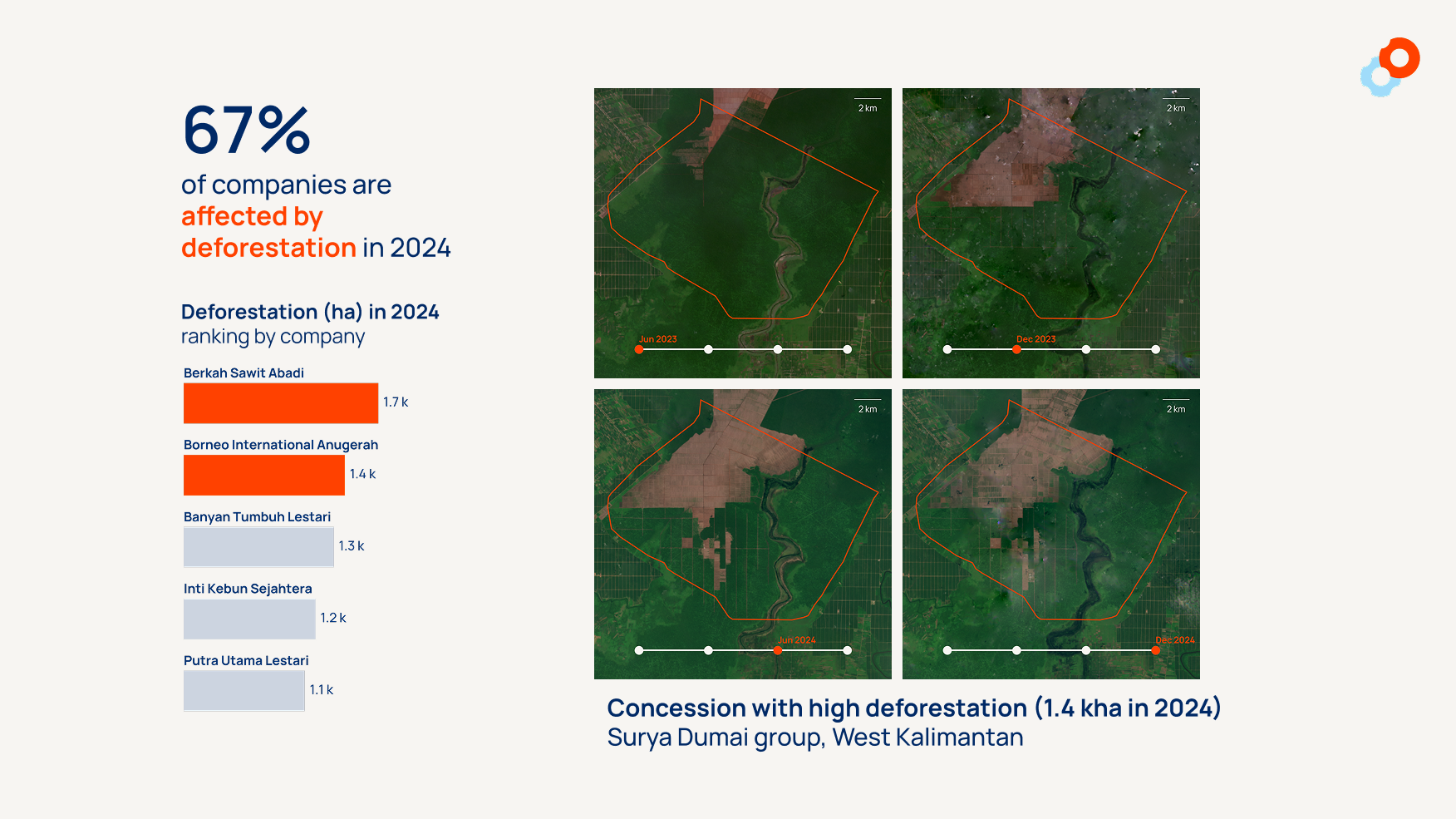

Another key finding is the difference in the proportion of companies engaged in deforestation. In 2024, 67% of companies operating in Indonesian oil palm concessions recorded deforestation, compared to 23% in Malaysia.

The 2024 data highlights specific companies leading in deforestation within their respective regions. For Indonesia, Berkah Sawit Abadi and Borneo International Anugerah – both subsidiaries of First Borneo – recorded the highest levels of deforestation at 5.1 thousand hectares combined.

In Malaysia, Shin Yang Group (335.3 hectares) and Innoprise Plantations Berhad (220 hectares) have the highest deforestation levels, despite the country’s overall stable deforestation trend.

By highlighting such companies, Satelligence’s monitoring system allows businesses and stakeholders to engage with suppliers based on reliable, verified data and insights, ensuring accountability and transparency in palm oil supply chains. Prioritized risks can therefore be identified, and targeted mitigation measures can be effectively implemented.

33% of Indonesia’s concession areas remain forested, comparable to Malaysia’s 12%.

Remaining Forest in 2024: Understanding the Differences

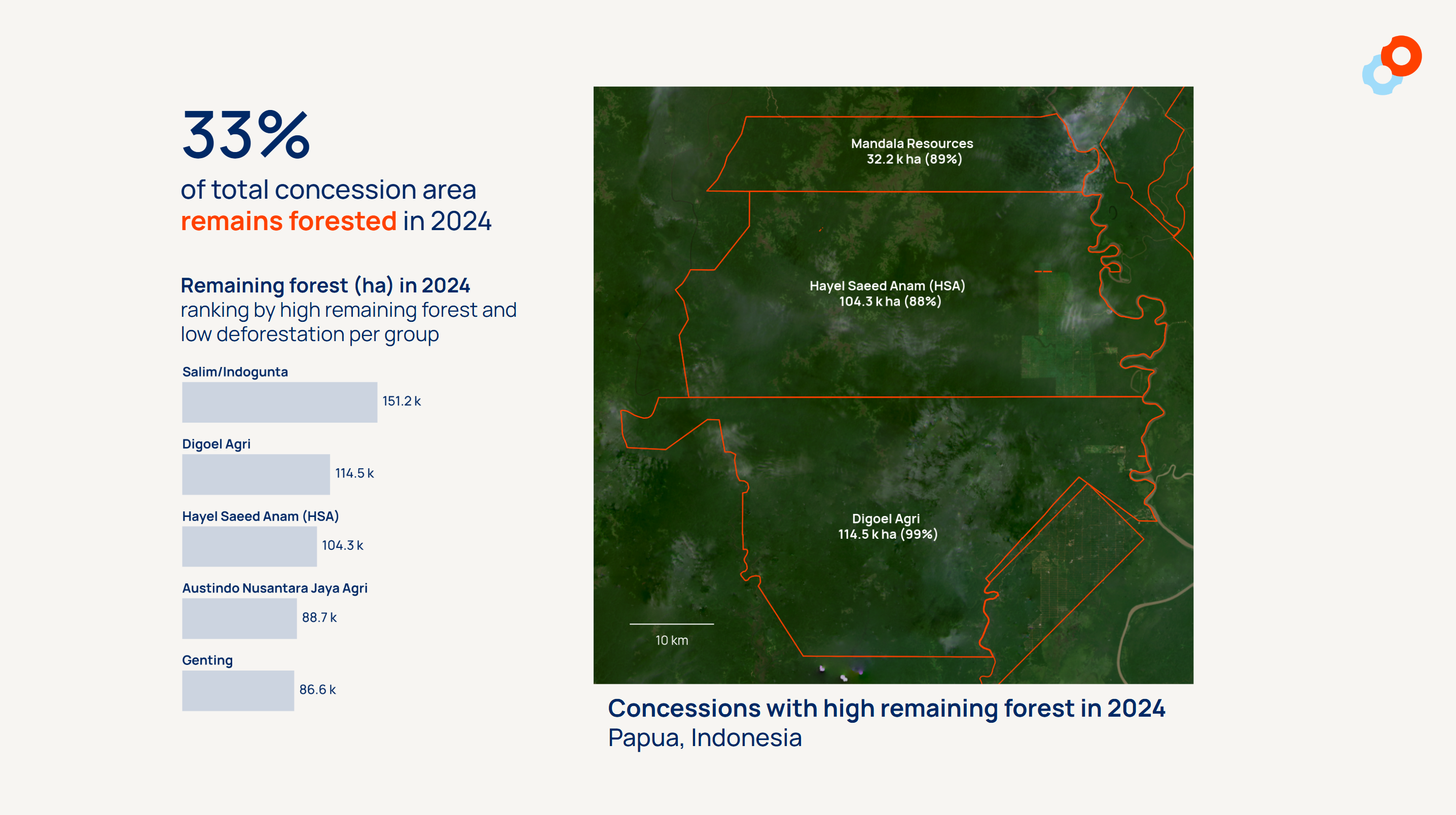

The percentage of remaining forest cover within oil palm concessions is another key metric to assess. In Indonesia, 33% of concession areas remain forested, whereas only 12% of Malaysia’s concession areas still have forest cover.

This difference confirms that Malaysia has less remaining forest available for potential deforestation, explaining why fewer companies are impacted by deforestation. In Indonesia, large tracts of forested concession land remain, making it all the more critical to track future changes.

Were we to imagine that the 2024 level of deforestation (a loss of 122,000 hectares) was to continue, Indonesia’s current palm oil concessions would be entirely cleared of forest within 65 years. Given that the country’s deforestation rates are in fact increasing, this timeline could be even shorter.

An example of a concession with high levels of remaining forest is the Digoel Agri Group, operating in Papua, Indonesia. A large amount of forest suggests that this is an area at high risk of deforestation; in this regard, Satelligence insights enable clients to make an informed decision on avoiding sourcing from this area and make a more sustainable choice for their supply chain.

Conclusion: Potential for Progress in Indonesia

The findings from our analysis highlight crucial differences in deforestation trends between Indonesia and Malaysia, in particular demonstrating how remaining forest cover influences deforestation risk. Malaysia has less forest cover in its oil palm concessions, whereas Indonesia still has significant forested areas that could be impacted by future land-use changes.

From this data, we can see that although Malaysia may not experience large increases in deforestation within concessions, Indonesia remains more dynamic, with risks fluctuating over time. The ability to continuously track deforestation patterns with confidence is essential for understanding long-term trends and ensuring compliance to regulations such as the EUDR. Supported by highly accurate and timely data, as well as Satelligence’s expert insights, stakeholders can anticipate risks and respond with confidence.