Setting a Path to the Finish Line

At COP27, as part of the global drive towards 1.5C, thirteen of the world’s largest agricultural trading and processing companies presented a roadmap towards halting commodity-linked deforestation in their supply chains. According to the IPCC, agriculture, forestry and other land uses contribute approximately 23% of anthropogenic emissions and deforestation causes a significant portion of that.

The road to 1.5°C is paved with intact forests.

The popular view of big agriculture vs. NGOs vs. governments is oppositional and outdated. The deforestation-free supply chains of the future will be built on collaboration, best practices, data sharing, and partnerships. The roadmap’s collaborative spirit will be pivotal to its success, and what do most of the signatories have in common? They work with Satelligence.

For a roadmap, there’s a lot of talk about the destination, but not enough about the journey. The industry’s finish line fixation means we’re not paying enough attention to the measures that traders are already taking to halt supply chain deforestation. As the market leader in zero-deforestation solutions, allow us to walk you through how big agriculture is winning the race towards zero deforestation in commodity supply chains.

Going for a Personal Best: Time Bound Targets

Cut-off dates are the foundation of any good zero deforestation implementation plan. In the case of the EU Regulation on Deforestation-Free Products, companies will not be able to trade products that are associated with deforestation that took place after the cut-off date of 31 December, 2020. Many large agricultural companies have already committed to voluntary pledges with earlier cut-off dates, such as 2008 for soy, 2015 for palm oil and 2018 for cocoa.

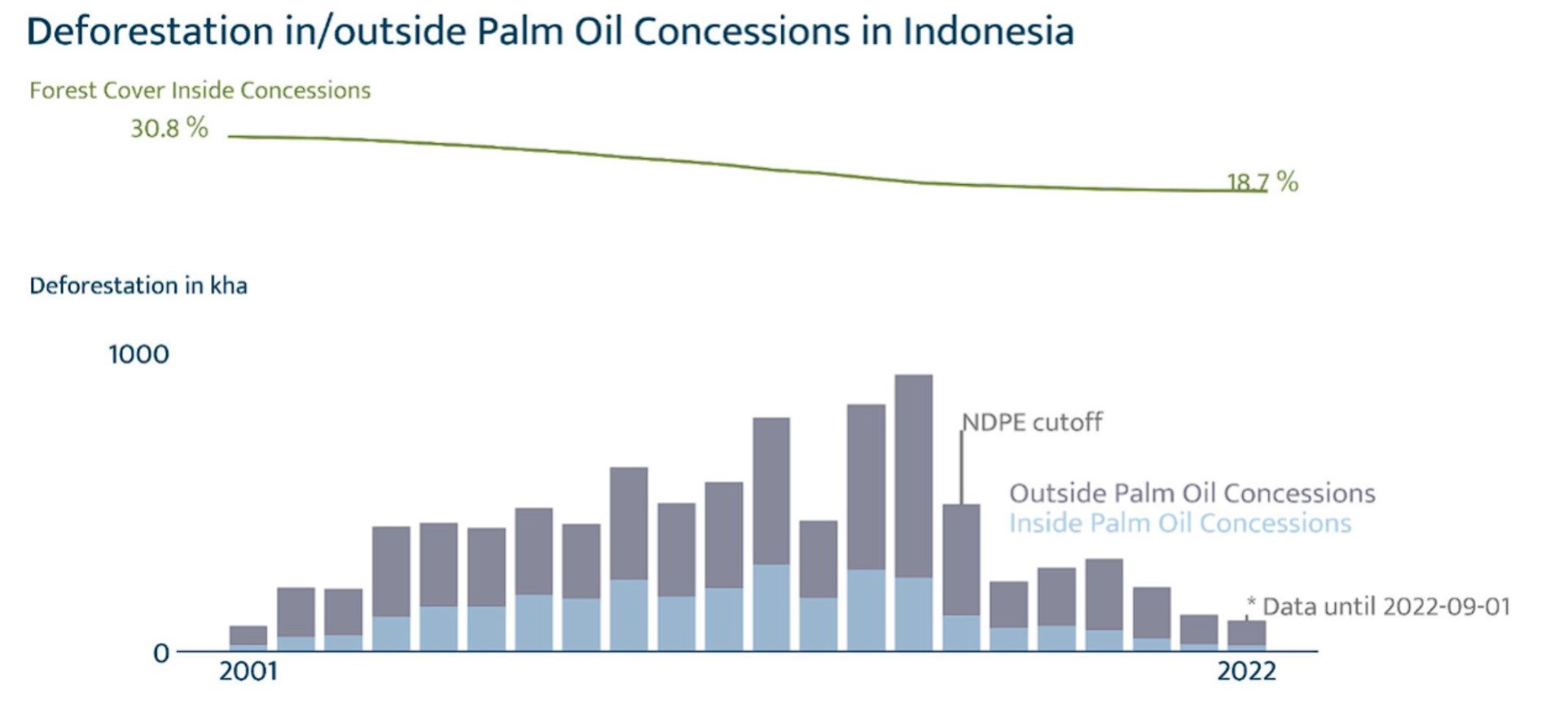

The EU’s 2020 cut-off date will be the bare minimum expected of EU trading companies. Satelligence’s forest baseline mapping services have helped companies like Mondelez prove their products are deforestation free even further in the past, to meet their 2015 No Deforestation, No Peat, No Exploitation (NDPE) commitments.

Running Through the Wall: Scope

The inclusion of scope 3 emissions in mandatory disclosures, as proposed by the US Securities and Exchange Commission, for example, means upstream supply chain entities are accountable for downstream emissions and deforestation; companies will be working with a much broader scope of responsibility. This is reflected in the roadmap, which states that companies must drive towards zero deforestation for direct and indirect suppliers across all geographical regions.

Until recently, checking deforestation levels associated with commodity production has involved boots-on-the-ground checks, infrequent audits, and policy over practice. The emergence of satellite and radar data has changed this dynamic for good through the establishment of deforestation alerting systems, baseline maps and carbon footprinting assessments. Touton uses our baselines to assess deforestation risks. Carble and Rabobank Acorn are using our carbon footprinting algorithms to help smallholder farmers get paid for sequestering carbon. Bunge uses our deforestation alerting systems to capture deforestation risks in their palm oil supply chains in real-time.

However, not all datasets are created equal. The problem with many public deforestation monitoring datasets is that land-cover change detection tools need to be tweaked for each commodity, habitat type, and for the environmental risk one wants to monitor. Satelligence uses an ISAE-3000 Type 1 Certified algorithm utilising machine learning to ensure that their findings about deforestation risks are accurate, no matter the commodity or region.

Staying on Track: Supply Chain Mapping & Traceability

Using satellite monitoring to halt deforestation may sound technical, but it’s actually the easy part of the puzzle. The tricky part is navigating the quagmire of global supply chains; understanding what companies own what farms, who buys what from those farms, and tracing accountability within the supply chain, from tree to shelf.

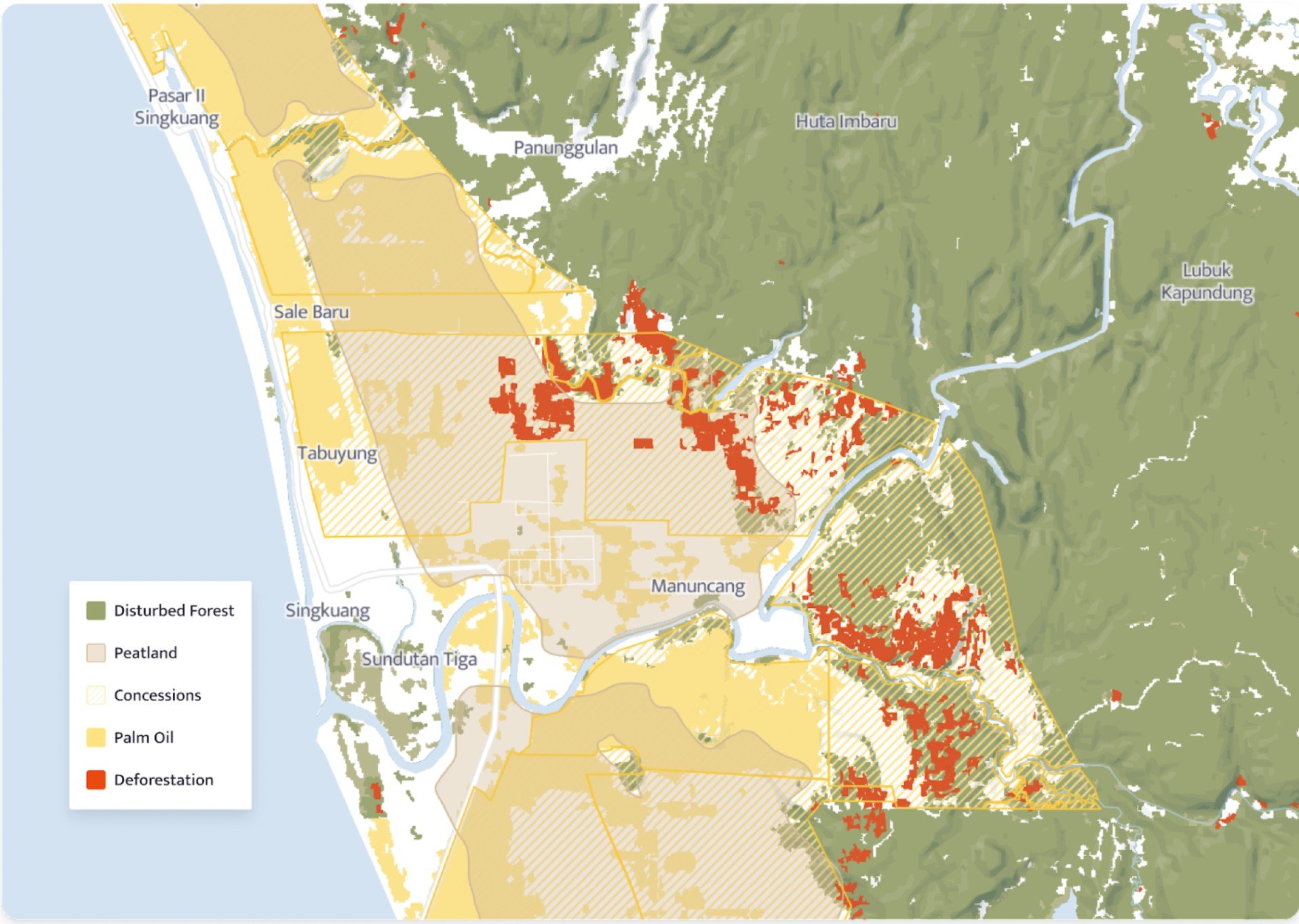

Ancillary data can be hard to come by. For example, In Indonesia, it’s illegal for companies that produce palm oil to share their locations externally. Where it’s impossible to find the exact location that commodity production takes place, Satelligence applies a regional-risk-based approach using the best available data.

Many traders are undertaking unprecedented supply chain mapping exercises with us, so that they can better understand what crops are growing where and whether they’re suitable for agroforestry techniques that could sequester even more carbon.

Check out our historical mapping exercise of Papua New Guinea’s coconut sector for Sime Darby here.

Keeping BPMs Consistent: Monitoring & Response

It’s not enough to know where and why deforestation is happening in the supply chain, companies need to take action, and engage with suppliers to mitigate risks and change practices.

Satelligence’s near-real time alerting system allows companies to receive continuous information about nature-related risks like deforestation. These risks are ordered by priority, helping companies commit resources efficiently and capture risks before they spiral. It’s also possible to identify which areas are vulnerable to future deforestation.

Buyers can get aggregated information about their supply chains, and use this to monitor compliance over time, check progress or initiate stop work orders. The Consumer Goods Forum’s Monitor and Response Framework provides guidance on how companies can best engage with suppliers.

The Race to Zero Deforestation Can be Won: Palm Oil Case Study

Much of Indonesia’s palm industry players use active satellite monitoring to mitigate supply chain deforestation.

2015, the cutoff date for the No Deforestation, No Peat, No Exploitation (NDPE) to reduce deforestation in supply chains, was the beginning of a sharp decline for deforestation rates in Indonesia. In the six years that followed, our data showed that Indonesia’s palm oil sector reduced levels of deforestation by 87%; from 907,513 ha to 119,363 ha. Data for 2022 has shown that deforestation related to palm oil has decreased to 102,130ha, a drop of 17,233 ha.

Ambitious corporate sustainability commitments combined with effective partnerships through bodies such as Sustainable Palm Oil Choice, and the deployment of the latest technology are a sure sign that palm oil stakeholders are turning pledges into meaningful, measurable progress. Other sectors can look at the ongoing progress of palm as a sign that eliminating deforestation in commodity supply chains is an achievable goal, and the key to winning the race to 1.5C.