Managing (environmental) risk in supply chains is a complex business. Deforestation risk, for example, is an essential component for frameworks such as EUDR, NDPE, or emissions monitoring. Ambiguous definitions, incomplete data and the sheer scale can be overwhelming, making it a tardy process, bound to stall in good intentions.

Monitoring for deforestation in supply chains is a great first step. Next is what to do with the results. Should every deforestation alert mean immediate expulsion of nearby farms or plantations from a supply chain? How rigorous should we regard compliance and risk; is it black and white, or are there shades of grey (or green)? Satelligence works with clients providing them with deforestation information and helping them determine what to do next. Here is our take on the best practices for deforestation, EUDR compliance and risk.

Deforestation, detected or not?

To know if deforestation is relevant for your supply chain, you need 3 things:

- Where is the forest on the baseline date (the Forest Base Line)?

- Has that forest disappeared between the baseline date and now (=deforestation)?

- Is that deforestation linked to my supply chain?

This is where it is important to get the foundations right. A coherent and consistent understanding of where the forest is, leads to accurate deforestation alerts. That makes follow-up on these alerts feasible, unlike when you use public data sources that result in many false deforestation alerts. Read more about the over- and underestimation of forest cover in public data sources and how the Satelligence approach compares here.

Prior to the EUDR coming into force, deforestation detection did not focus as much on farm plots. Compliance with frameworks such as NDPE and RSPO was mainly checked by monitoring sourcing landscapes. With EUDR compliance, most companies are moving towards obtaining plot-level traceability for those commodities included in the regulation. Collecting plot data for farms is a massive task, which we discussed in our first ‘Best Practices’ blog and session. However, once this is completed, monitoring becomes much easier. First, it is clear whether a deforestation event is directly related to a supply chain. Second, there is a way to engage with the suppliers involved and address the issue with them.

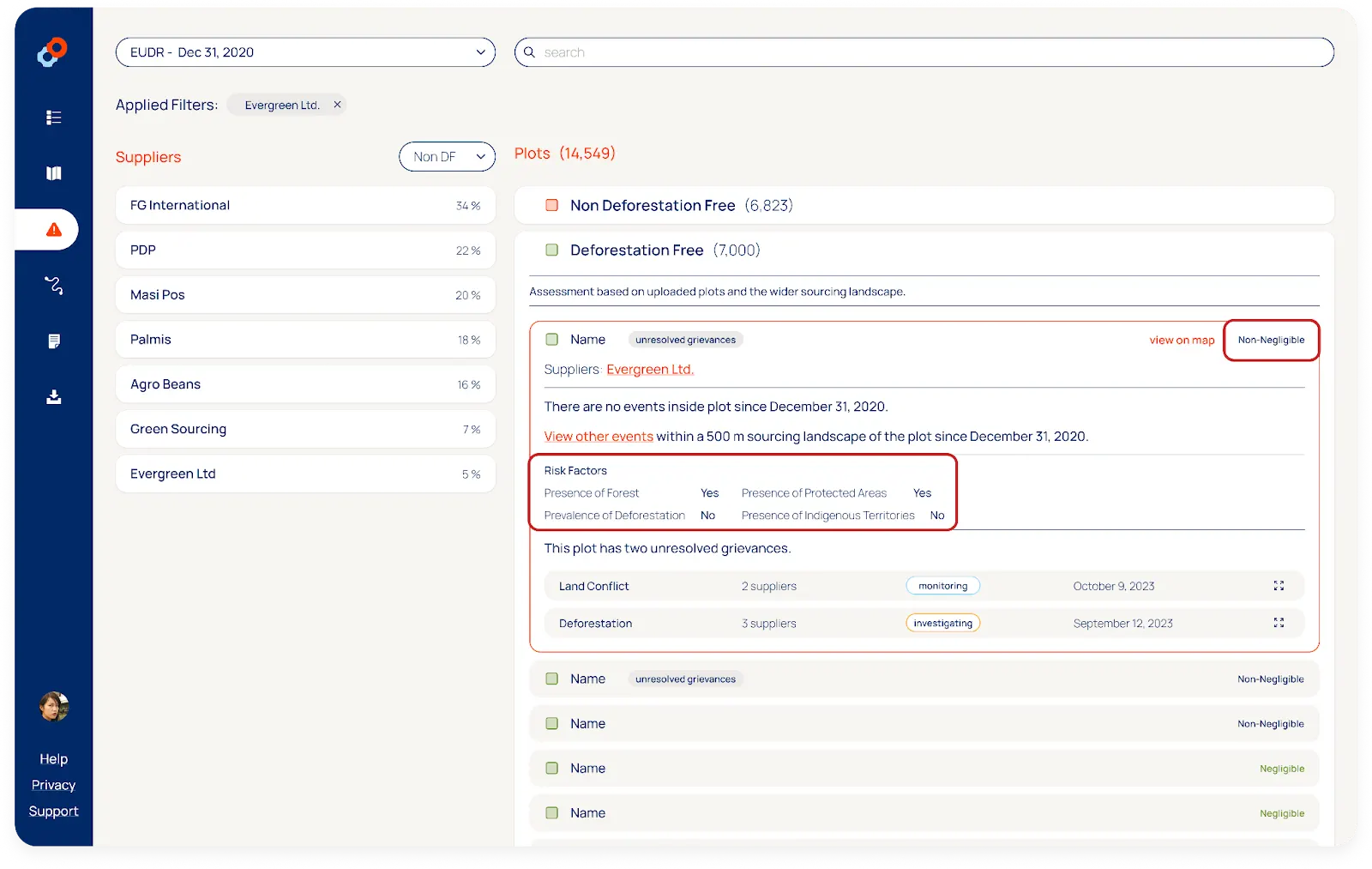

Nevertheless, there are some pitfalls. Technically, when deforestation is detected within a plot after the EUDR cut-off date, it renders the plot non-compliant (as per EUDR Article 3a). Therefore the produce from these plots cannot be placed on the European market. Does that then mean this plot should immediately be excluded from the supply chain?

EUDR compliance unmet, what now?

When a plot in a supply chain has been flagged as non-compliant, it is good practice to familiarise yourself with the surroundings of the plot. For instance, has more deforestation been detected in the area? Then you can contact the supplier and ask for further information. One question is whether the plot data might be inaccurate. Plot data quality (points or polygons) varies wildly and mistakes do happen. Indicators of data collection mistakes are, for example: a plot is further removed from the mill or cooperative than others are, or patterns within the plot data that indicate that data was projected wrongly (see examples in this article).

Meanwhile, it remains the company’s responsibility to do its due diligence on its supply chain and thus ensure the correctness of the traceability and plot data. Hence, a correction of a polygon by a supplier should only be accepted when the initial polygon was incorrect. Satelligence has crop commodity layers for many areas, which helps to determine to what extent the supplier plot data corresponds to the planting area of a crop.

Another question is what changes the supplier has observed in this plot since the compliance framework cut-off date. Is this an old plantation which has recently been cleared for replanting? Is it an agroforestry plantation?

It is important to collect photographic evidence of the situation on ground. With Satelligence, you can check the validity of such evidence through the deforestation timeline in the platform and the Very High Resolution (Planet) satellite background layer. Satelligence guarantees 95% accuracy of our change data, hence claims of a false positive detection need to be well-supported.

When there is no reasonable explanation for non-compliance of a plot, produce from the plot has to be excluded from the supply chain. To guarantee this, due diligence also includes cross-checking the volumes provided compared to the surface area of the compliant plots.

How to assess & manage risk

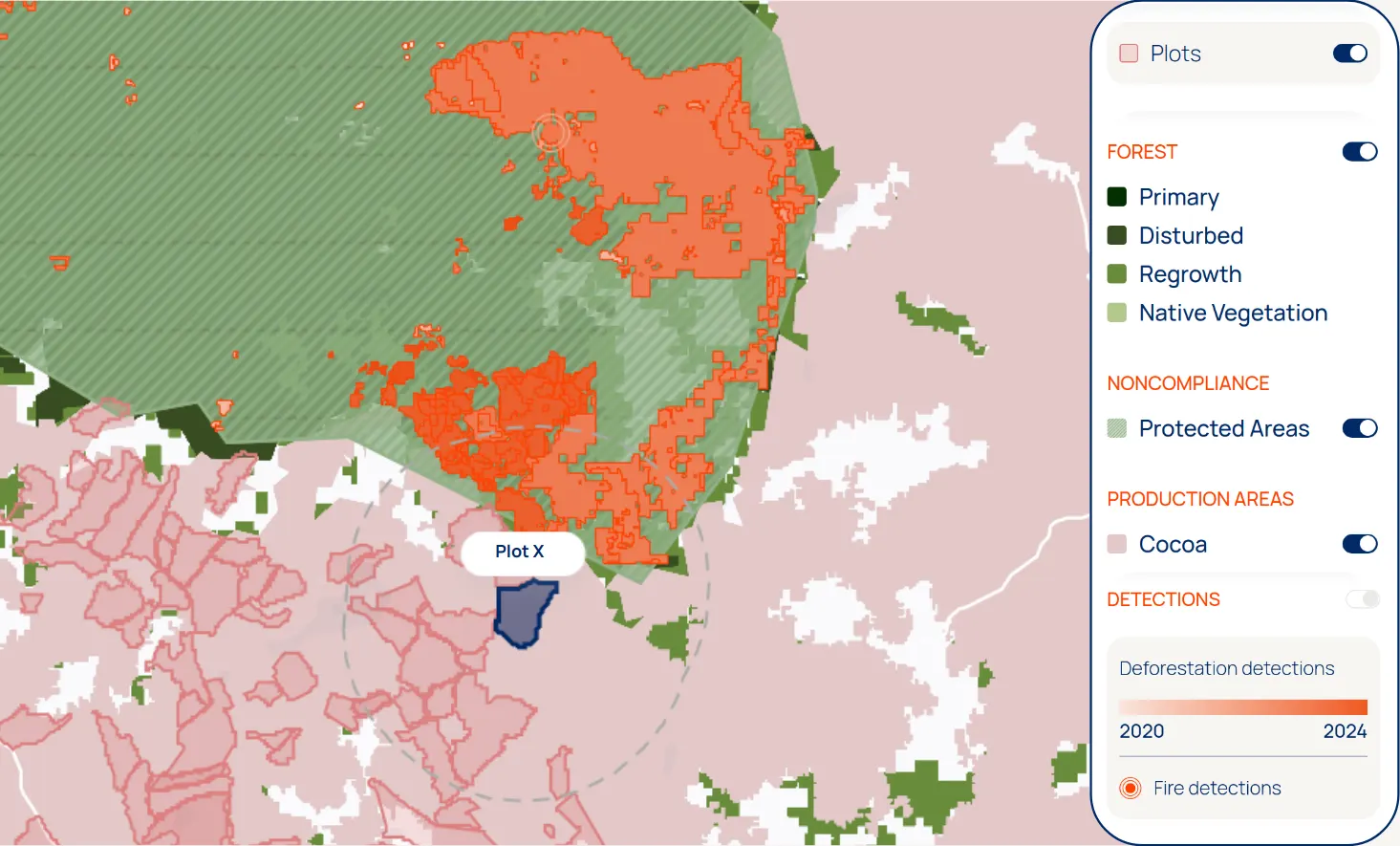

Once the supply is operationally monitored and there is a protocol to process potential non-compliant plots, the next step is to address future deforestation risk. To simplify deforestation free sourcing, especially from smallholder farmers, industry organisations such as the Consumer Good Forum’s Forest Positive Coalition have been working on a shared understanding of where risks are negligible. EUDR spurred that on by requiring that deforestation risk is assessed and, when non-negligible, mitigated. Based on our long-standing experience with deforestation risk assessment, combined with the EUDR requirements, we look at four factors to determine if plots have a non-negligible risk:

Presence of forest: whether the plot contains forest or there is forest within 500 metres of the plot boundary (the radius can vary per crop).

Presence of protected areas: whether the plot is inside a protected area or there are protected areas located within 500 metres of the plot boundary.

Presence of indigenous territories: whether the plot is located inside community land or in an area designated as indigenous territory or those areas are within 500 metres of the plot boundary.

Prevalence of deforestation: whether there is detected deforestation since the EUDR cut-off date within 500 metres of the plot boundary.

Despite a plot being deforestation free, all the non-negligible risk needs to be mitigated. Methods are not yet well-defined in the industry. Satelligence advocates the following three best practices:

- For non-compliant plots, additional checks into the correctness of the plot boundary are warranted. As are cross-checks on aggregation points in the supply chain on whether the volumes may reasonably come from the provided plots.

- For plots inside or within 500m of protected areas or indigenous territories there are legality risks. The plot might be located in an illegal area or the production is not in “consultation and cooperation in good faith with indigenous peoples” (EUDR Art. 10 crit. d). The best practice is to request additional documentation and evidence from your supplier.

- For plots with the presence of forest or prevalence of deforestation risk factor, ongoing monitoring is essential. Satelligence helps with visibility on the forest and changes to it in near real-time. This allows for quick follow-up with suppliers and can prevent non-compliant commodities from entering the supply chain.

If any or all risk factors are present, then the plot is labelled as non-negligible risk and requires risk mitigation to meet EUDR-compliance. If no factors are present, then the plot is labelled as negligible risk. The EU is also expected to indicate which countries/areas are considered lower or higher risk. In our view, assessing risk per plot remains essential as risk level can vary drastically from area to area, even within countries.

Besides assessing and mitigating risk, it is also important to monitor (potential) supply chain grievances. This helps mitigate and monitor risks more broadly. Grievance tracking includes deforestation risks, but may also include human rights violations or potential land conflicts. Best practice is to have a central registry of such issues either flagged by the company, by suppliers or by third parties. The registry should record how the issue was raised, what follow-up was done and what the result was. As above, we advise to request additional documentation and evidence from potential suppliers involved. The Satelligence platform provides such a registry in the form of an integrated grievance tracker where you can flag, follow-up, and monitor (potential) grievances.

Beyond the plot

When evaluating their supply chains, companies must look beyond individual plots or narrow 500-metre buffers. True sustainable sourcing demands a comprehensive understanding of forest health and broader environmental risks. That’s why continuous monitoring of entire sourcing landscapes for deforestation and other risk factors is essential.

Satelligence has the strongest focus on global, multi-commodity monitoring. By providing consistent, curated real-time data across extensive areas, we aim to empower businesses to manage risks effectively and maintain compliance with sustainability regulations. Gain the clarity you need to make informed decisions and uphold your sustainability commitments!

Start Your EUDR Compliance Journey

Schedule a free guidance session on leveraging satellite data and supply chain monitoring for your EUDR compliance needs.